Infographic Are You Keeping Up With FinTech in 2021?

By Insight Editor / 20 Jan 2021 / Topics: Data and AI Cloud Cybersecurity Intelligent edge

By Insight Editor / 20 Jan 2021 / Topics: Data and AI Cloud Cybersecurity Intelligent edge

Ask yourself: Is your IT where it needs to be to keep up in the world of finance? Financial organizations are experiencing some of the most rapid changes of any industry and it’s thanks in large part to technology. Big data, automation, security — these are the areas organizations like yours need to be thinking about and investing in.

Accessibility note: The infographic is transcribed below the graphic.

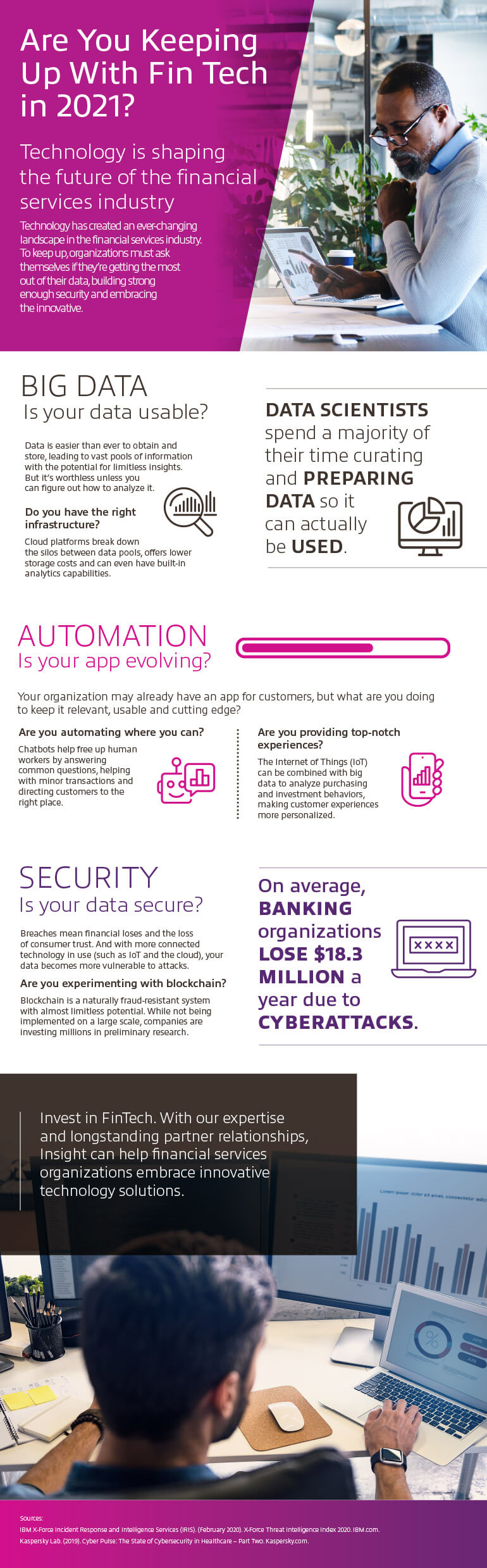

Are You Keeping Up With FinTech in 2021?

Technology is shaping the future of the financial services industry.

Technology has created an ever-changing landscape in the financial services industry. To keep up, organizations must ask themselves if they’re getting the most out of their data, building strong enough security and embracing the innovative.

Big Data

Is your data usable?

Data scientists spend a majority of their time curating and preparing data so it can actually be used.

Data is easier than ever to obtain and store, leading to vast pools of information with the potential for limitless insights. But it’s worthless unless you can figure out how to analyze it.

Do you have the right infrastructure?

Cloud platforms break down the silos between data pools, offers lower storage costs and can even have built-in analytics capabilities.

Automation

Is your app evolving?

Your organization may already have an app for customers, but what are you doing to keep it relevant, usable and cutting edge?

Are you automating where you can?

Chatbots help free up human workers by answering common questions, helping with minor transactions and directing customers to the right place.

Are you providing top-notch experiences?

The Internet of Things (IoT) can be combined with big data to analyze purchasing and investment behaviors, making customer experiences more personalized.

Security

Is your data secure?

On average, banking organizations lose $18.3 million a year due to cyberattacks.

Breaches mean financial loses and the loss of consumer trust. And with more connected technology in use (such as IoT and the cloud), your data becomes more vulnerable to attacks.

Are you experimenting with blockchain?

Blockchain is a naturally fraud-resistant system with almost limitless potential. While not being implemented on a large scale, companies are investing millions in preliminary research.

Sources

Ponemon Institute. (2019). The Cost of Cybercrime. Accenture.com.

Discover reports, stories and industry trends to help you innovate for the future.